The true cost of the great Medicaid “unwinding”

Published April 13, 2023

During the crisis and suffering of the COVID-19 pandemic, the US federal government protected health care coverage by forbidding states from disenrolling Medicaid recipients. There were a few exceptions, like if a person died or if they moved out of state. As a result, the uninsured rate in the US reached a historic low of 8%. Meanwhile, Medicaid rolls swelled to record highs.

The continuous enrollment mandate ended on March 31, 2023. Some states have been eager to cull their Medicaid rolls, citing financial strain. But a study from IHME on health care spending shows that the cost savings of cutting Medicaid spending aren’t so simple. The August 2022 study tracked health care spending by state from 2000 to 2019 in order to understand what the main drivers of spending are and to figure out which drivers policymakers can influence. After controlling for age, regional consumer prices, average personal income, and behavioral health risks, the study found that health care spending is mostly explained by income levels and local prices, which vary widely and aren’t elements that policymakers can control. Medicaid spending, however, is something policymakers do have a say about.

A complex relationship between Medicaid expansion and health care spending

On a national level, the study found that Medicaid spending was associated with a 1% increase of health care spending overall between 2000 and 2019 – a significant but much smaller cost-driver than income or prices. In the states that expanded Medicaid after the Affordable Care Act became law, Medicaid expansion drove spending increases, but the amount people spent out-of-pocket was less in those states. One of the complexities the study uncovered is that though Medicaid expansion is associated with higher spending at a national level, that isn’t always true on the state level. When comparing two states side-by-side – rather than lumping all 50 together – Medicaid expansion sometimes corresponded to lower overall spending.

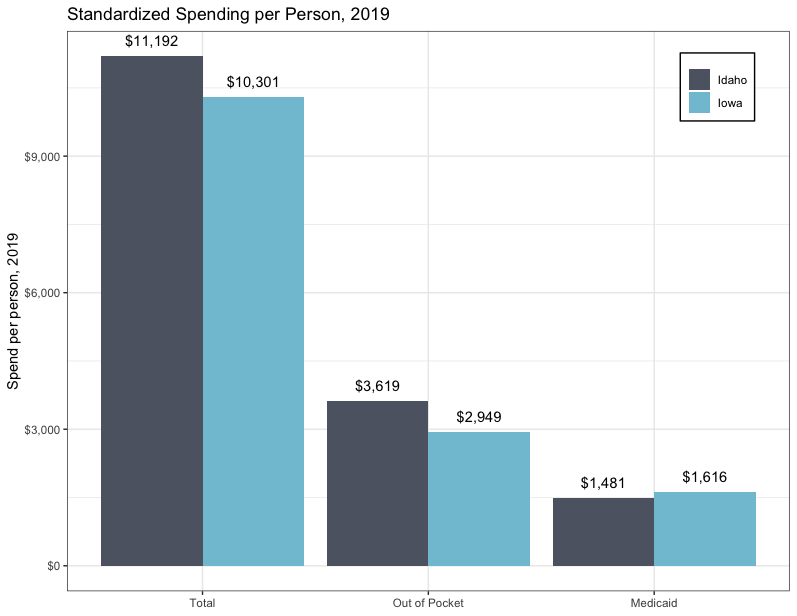

In 2019, for example, Idaho (prior to its Medicaid expansion, which took effect January 2020) spent $11,192 on health care per person, and Iowa (which expanded Medicaid in 2014) spent $10,300 when controlling for income, prices, urbanicity, and population characteristics. This spending includes state spending, private insurance payouts, and out-of-pocket costs to consumers.

In Idaho, 13.2% of that spending went toward Medicaid, while in Iowa, 15.7% went to Medicaid. Though Idaho paid less toward Medicaid in 2019, it paid 9% more on health care per person than Iowa did, and out-of-pocket costs in Idaho were 23% higher than they were in Iowa in 2019. Standardized spending per person for each state is shown below in Figure 1.

Figure 1: Standardized Spending per Person, 2019, Idaho and Iowa

Contrary to expectations, Medicaid expansion may be a source of cost savings overall for Iowa. This suggests that in the short term, states may spend less on Medicaid after cutting people from the rolls, but they may also see overall health care spending go up over time. Iowa might be saving money because of the kind of care people seek when they are insured. People who have insurance are more likely to take advantage of preventive care and see a primary care doctor, for example, and they are less likely to seek high-cost care from an emergency room. In Iowa and at the national level, more insurance coverage also correlates to lower out-of-pocket spending.

What the return of Medicaid churn may mean for health spending

Before the continuous enrollment mandate, people could be kicked off Medicaid for a host of reasons – making too much money, for example, or failing to return correspondence. Contacting Medicaid enrollees to confirm their continuing eligibility had been a longstanding challenge nationwide even before the chaos of the pandemic years. And that’s just one aspect of the administrative burden that Medicaid patients have faced: before the 2020 enactment of the continuous enrollment mandate, each year about 10% of Medicaid recipients nationwide lost and then regained coverage within less than a year because they failed to complete renewal paperwork or because the state didn’t reach them in time. This phenomenon is known as Medicaid “churn.” Churn reduces the Medicaid rolls, which can reduce Medicaid spending, but it also interrupts continuity of care and creates higher administrative costs.

IHME’s study found that some of the people who are most affected by churn are also the groups most associated with long-term cost savings when Medicaid covers them. According to the Department of Health and Human Services (HHS), before the pandemic, people who had just given birth were at high risk of losing coverage due to Medicaid churn. Meanwhile, the Kaiser Family Foundation reports that churn rates doubled for children following the annual renewal date of their benefits. The IHME study found that when states made it easier for pregnant people to enroll in Medicaid by increasing the eligibility threshold by 10%, there was a 15% decrease in total out-of-pocket spending. Expanding Medicaid coverage to children was associated with less health care spending overall, and states that enhanced access to care for kids did not spend more in total long term than states that didn’t.

When the continuous enrollment mandate expired on March 31, Medicaid churn returned and the “great unwinding” of the Medicaid rolls began. The US Department of Health and Human Services estimates that 15 million people will lose insurance coverage during this unwinding. Of that number, 6.8 million will likely still be eligible for coverage. We don’t yet know what the ultimate consequences of the unwinding will be. But we do know that many people will lose benefits they still qualify for, restarting the human and financial costs of Medicaid churn, and possibly increasing overall health care spending in the long term.